MISSION & NICHE

Tezos is designed for safety, upgradability, and open participation. Tezos wanted better ways to coordinate decisions and upgrades. This project uses a unique system of formal governance and encourages more stakeholder participation.

Tezos also allows smart contracts to be formally verified where developers prove the correctness of their code to ensure it behaves as intended. This is great for industries with mission critical code (i.e. aerospace). This makes it easier to provide secure smart contracts that are less susceptible to bugs and cyber attacks.

I found Tezos’ whitepaper to be particularly outdated: https://tezos.com/static/white_paper-2dc8c02267a8fb86bd67a108199441bf.pdf

Tezos also allows smart contracts to be formally verified where developers prove the correctness of their code to ensure it behaves as intended. This is great for industries with mission critical code (i.e. aerospace). This makes it easier to provide secure smart contracts that are less susceptible to bugs and cyber attacks.

I found Tezos’ whitepaper to be particularly outdated: https://tezos.com/static/white_paper-2dc8c02267a8fb86bd67a108199441bf.pdf

TIMELINE & PARTNERSHIPS

- Arthur Breitman published the Tezos white paper in 2014, outlining defects of Bitcoin and possible solutions in Tezos. Arthur is a computer scientist who worked as a quantitative analyst at Goldman Sachs and Morgan Stanley, prior to devoting himself to Tezos.

- In 2015, Arthur and wife Kathleen (who worked for R3 and Bridgewater Associates), started Dynamic Ledger Solutions; a company out of Delaware that owned rights to Tezos source code.

- The Tezos Foundation is a Swiss non-profit that was run by Johann Gevers. The foundation was in charge of the Tezos ICO. There were issues with this process that resulted in a class action lawsuit, delayed protocol release, and the removal of Gevers. The foundation then hired Ryan Gesperson with business degrees from BYU and Duke.

- The Tezos ICO occured on July of 2017.

- Tim Draper, who is a well known venture capitalist and decentralization enthusiast, is an advisor for Tezos.

Updated partnerships are listed at the bottom of the Tezos home page:

https://tezos.com/

UPGRADES & GOVERNANCE

There are two main types of accounts in the Tezos protocol.

- Implicit accounts that begin with a “TZ1” public address.

- Originated accounts that begin with a “KT1” address. Originated accounts are where users stake their tokens in order to vote within the protocol. Funds must be transferred from implicit accounts to participate in the voting process. Originated accounts must vote before a hard fork can take place. Developers cannot decide to take the protocol in a new direction without this consensus. Tezos did this in order to make the protocol upgrade decisions more community focused.

- Voting cycles 1- 8 are the Proposal Period where Bakers propose a protocol upgrade and other Bakers can upvote the proposal. The baking developers can also include an invoice. If approved, the developer gets payment in Tezes. This incentivizes developers to work on protocol upgrades that interest them, instead of only working on what the rest of the community thinks is important.

- Voting cycles 9-16 are the Exploration Period where Bakers can vote to test the most upvoted proposals.

- Voting cycles 17-24 are the Testing Period where a testnet chain with the proposed upgrades forks off the mainet and runs for 48 hours.

- Cycles 25-32 are the Promotion Vote Period where Bakers can vote to promote the testnet chain on the mainet.

- If the adoption of the proposal is approved, then the new protocol activates and the developer/Baker who originally proposed the upgrade is paid the amount of newly minted tokens posted on their invoice. This helps incentivize developers from mechanisms within the network, instead of outside donations.

- All stakeholders can partake in network upgrades by proposing, evaluating, or approving suggested amendments.

- Bakers vote on behalf of all the tokens they represent.

- Voting cycles 1- 8 are the Proposal Period where Bakers propose a protocol upgrade and other Bakers can upvote the proposal. The baking developers can also include an invoice. If approved, the developer gets payment in Tezes. This incentivizes developers to work on protocol upgrades that interest them, instead of only working on what the rest of the community thinks is important.

CONSENSUS & SECURITY

The Tezos consensus mechanism is called Liquid Proof of Stake (LPoS). In LPoS, users can delegate their tokens to other accounts for block validation or they can vote with their own originated account. In LPoS, delegation rights can be transferred without transferring ownership. The more commonly known Delegated Proof of Stake (DPoS) allows for more scalability, while LPoS can help smaller token holders not get overlooked because they can still be block validators if enough stakeholders pass on their voting rights. In Tezos, stakers and validators are referred to as “bakers”, and the native XTZ tokens are called “Tez”. “Baking” a block is synonymous with producing a block.

Baking Tez secures transactions, and distributes rewards. Bakers must setup a node and have at least 8,000 Tez to be added to the delegate pool of up to 80,000 validator bakers. 8.25% of total baked tokens are frozen as collateral that is penalized if a validator baker behaves dishonestly. With up to 80,000 validator bakers, Tezos is setup to be far more decentralized (at the sacrifice of speed) than DPoS networks where there is a fixed number of much fewer validators; like EOS with 21 validators, TRON with 27 validators, and Lisk with 101 validators. LPoS can handle about 40-50 tx/sec.

Tezos validator bakers need less computing power to validate blocks because they are not one of only a few nodes validating transactions. Block rewards of Tez tokens are allocated based on how many Tez a validator is baking, rather than mining power like in the Bitcoin network. More validator bakers in the system also leads to less opportunity for corruption and collusion.

If a user wants to bake, they need to have enough Tez; in the amount of one “roll”, equal to 8,000 Tez. If a user does not want to bake, they can send their Tez to another baker. This chosen baker will keep a percentage of the roll holder’s Tez as a fee.

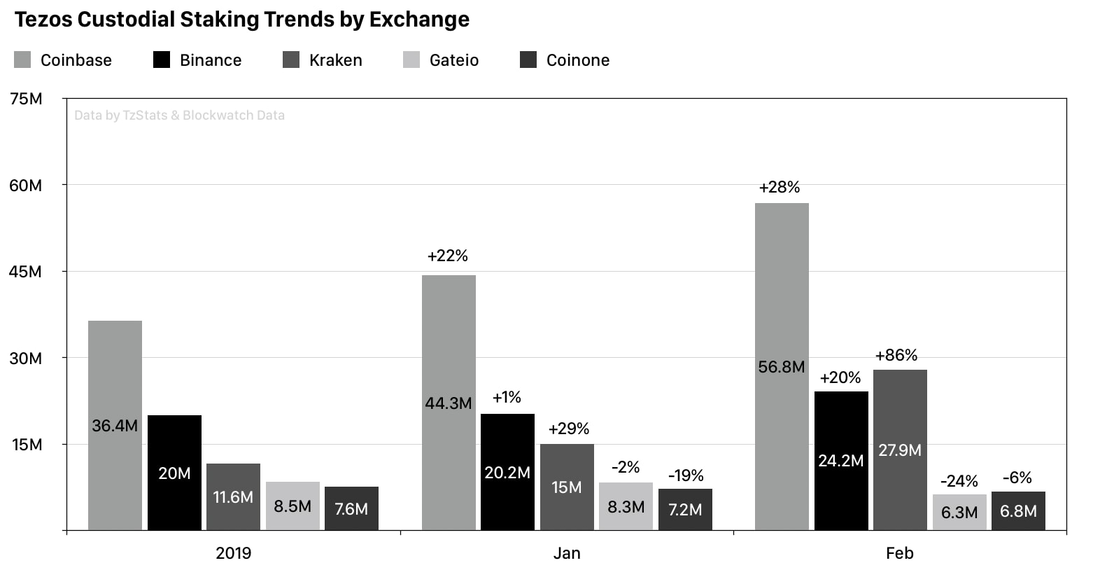

Even if a Baker isn’t selected as a validator, after about 35 days baking rewards are released and most bakers will earn rewards every few days that their baker is operational. https://mytezosbaker.com/ has a list of bakers, including the fees they charge and their staking yield for users. Because baking is made so simple there is about an 80% participation rate on baking. This is much higher than Bitcoin mining participation. Coinbase and Binance allow for Tezos baking, but tend to have some of the highest fees

Baking Tez secures transactions, and distributes rewards. Bakers must setup a node and have at least 8,000 Tez to be added to the delegate pool of up to 80,000 validator bakers. 8.25% of total baked tokens are frozen as collateral that is penalized if a validator baker behaves dishonestly. With up to 80,000 validator bakers, Tezos is setup to be far more decentralized (at the sacrifice of speed) than DPoS networks where there is a fixed number of much fewer validators; like EOS with 21 validators, TRON with 27 validators, and Lisk with 101 validators. LPoS can handle about 40-50 tx/sec.

Tezos validator bakers need less computing power to validate blocks because they are not one of only a few nodes validating transactions. Block rewards of Tez tokens are allocated based on how many Tez a validator is baking, rather than mining power like in the Bitcoin network. More validator bakers in the system also leads to less opportunity for corruption and collusion.

If a user wants to bake, they need to have enough Tez; in the amount of one “roll”, equal to 8,000 Tez. If a user does not want to bake, they can send their Tez to another baker. This chosen baker will keep a percentage of the roll holder’s Tez as a fee.

Even if a Baker isn’t selected as a validator, after about 35 days baking rewards are released and most bakers will earn rewards every few days that their baker is operational. https://mytezosbaker.com/ has a list of bakers, including the fees they charge and their staking yield for users. Because baking is made so simple there is about an 80% participation rate on baking. This is much higher than Bitcoin mining participation. Coinbase and Binance allow for Tezos baking, but tend to have some of the highest fees

SUPPLY & INFLATIONARY CONTROLS

The circulating supply of Tezos as of March 13th, 2020 is 703,572,333 XTZ. Supply in the Tezos ecosystem occured through the initial token sale, and is now generated through block validation “baking” and invoices of newly accepted proposals of protocol upgrades from Tezos developers. There is no maximum supply designated for Tezos. This is likely due to the project wanting to maintain a consistent way to incentivize block production and new protocol development.

TECH

OCaml is the programming language used for the network, and “Michaelson” is used for smart contracts.

Michaelson makes it easier to integrate smart contracts into the Tezos virtual machine (VM). Michaelson is written in a human legible text format; unlike the Ethereum Virtual Machine which is written in bytes; thus the opcode is not as cryptic. Michaelson facilitates formal verification. With Michelson being stack-based, computations are performed by changing a sequence of data elements (the stack) according to a sequence of instructions (the program). Modular architecture and formal upgrade system make updates to the protocol relatively easy. Michaelson is moving towards another, even easier to use, programming language called LIGO.

Michaelson makes it easier to integrate smart contracts into the Tezos virtual machine (VM). Michaelson is written in a human legible text format; unlike the Ethereum Virtual Machine which is written in bytes; thus the opcode is not as cryptic. Michaelson facilitates formal verification. With Michelson being stack-based, computations are performed by changing a sequence of data elements (the stack) according to a sequence of instructions (the program). Modular architecture and formal upgrade system make updates to the protocol relatively easy. Michaelson is moving towards another, even easier to use, programming language called LIGO.

About Me:

BA in Economics. BS in Finance.

Hostess of the Crypt Keepers’ Club.

Passionate about research and data.

I don’t fold sheets, I spread them.

Hostess of the Crypt Keepers’ Club.

Passionate about research and data.

I don’t fold sheets, I spread them.

Connect with Me:

Note that you must be logged into Facebook to be directed to my page.

DISCLAIMER:

Keep in mind that information on this site is only from my perspective, and this industry is constantly evolving. Do more research. Be accountable for your decisions.

ALL INVESTMENTS ARE DONE SO AT YOUR OWN RISK!

Keep in mind that information on this site is only from my perspective, and this industry is constantly evolving. Do more research. Be accountable for your decisions.

ALL INVESTMENTS ARE DONE SO AT YOUR OWN RISK!

Have something constructive to add? Do so in this comment box, below.

BE KIND! Insecure egos do not appeal to anyone's better nature.

© COPYRIGHT 2017-2021 ALL RIGHTS RESERVED.