INCEPTION DATE

Bitcoin Cash represents a hard fork in the Bitcoin network that occurred at at block 478,558 on August 1st 2017. For each bitcoin (BTC) held, an owner received 1 Bitcoin Cash (BCH).

MISSION & NICHE

"Peer-to-Peer Electronic Cash

Enabling new economies with low fee micro-transactions, large business transactions, and permissionless spending."

Enabling new economies with low fee micro-transactions, large business transactions, and permissionless spending."

Bitcoin Cash is a Bitcoin core based blockchain; much like Litecoin, Dogecoin, and Digibyte. Bitcoin Cash adopts the same Satoshi Nakamoto white paper as Bitcoin, published October 31st, 2008.

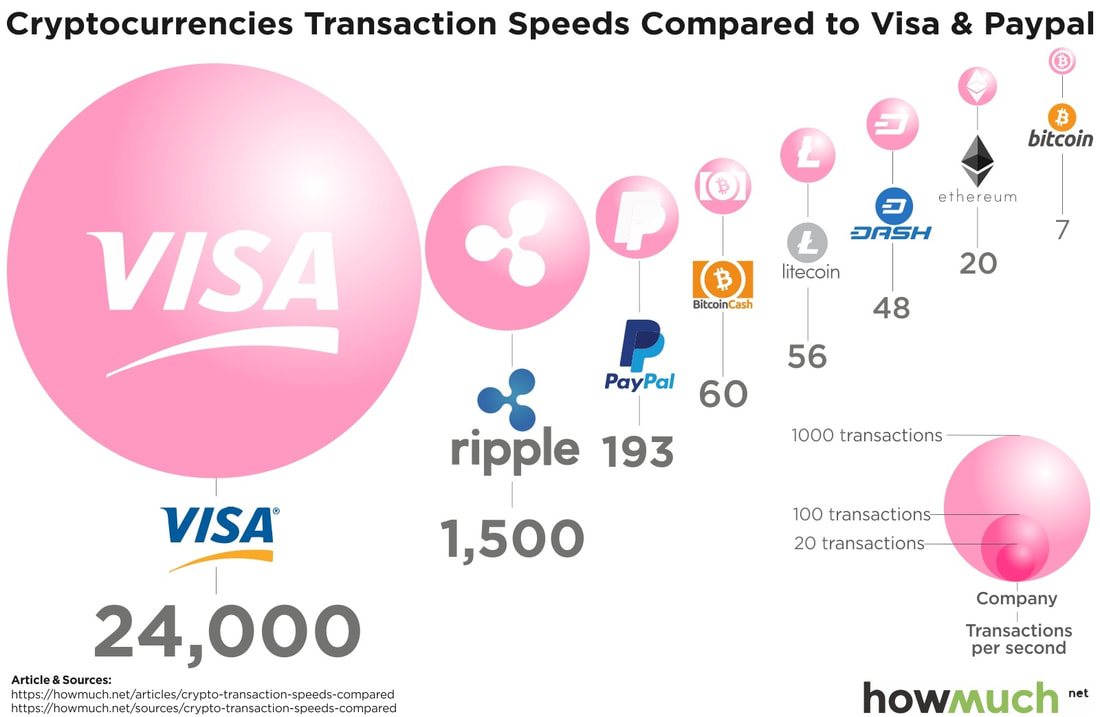

The primary mission of Bitcoin Cash is to make a currency with many of the Bitcoin core features, that is more scalable. The size of the block of transactions in the Bitcoin network was limited to 1 megabyte (now 2MB). This causes delays in transaction processing time. Bitcoin Cash increased the size of the block of transactions to 8 megabytes; allowing for many more transactions to be processed, per block. This increase in block size results in more transactions per second that can be processed in the Bitcoin Cash network. Bitcoin Cash has the same 10 minute confirmation time interval as Bitcoin. However, many more transactions are processed within those 10 minutes, because more transactions are able to fit into the block that is being mined.

Prior to Bitcoin Cash, if a user wanted to speed up the processing time of their transaction (especially considering the block sizes were small, so not as many transactions can fit in a block), they had to tack on a hefty transaction fee to incentivize Bitcoin miners. Over time, this has made the Bitcoin network more conducive to processing larger transactions, where a larger processing fee is not as deterring for making the transaction. With automatically faster transactions due to increased block size, Bitcoin Cash allows for users to more readily send payments at very small fees. This helps Bitcoin Cash fulfill a nice for smaller micropayments (i.e. tipping a content creator), as well as be able to handle larger transactions.

Bitcoin Cash also did away with Bitcoin's Replace By Fee (RBF) feature. Thus, with Bitcoin Cash, double-spends are less likely because a user cannot spend money to make a purchase at a relatively lower fee at one merchant, then quickly go to another merchant and spend the same money (at a relatively higher fee) before the first purchase is confirmed; enabling them to spend the same money, twice and obtain double the value of goods and services.

The primary mission of Bitcoin Cash is to make a currency with many of the Bitcoin core features, that is more scalable. The size of the block of transactions in the Bitcoin network was limited to 1 megabyte (now 2MB). This causes delays in transaction processing time. Bitcoin Cash increased the size of the block of transactions to 8 megabytes; allowing for many more transactions to be processed, per block. This increase in block size results in more transactions per second that can be processed in the Bitcoin Cash network. Bitcoin Cash has the same 10 minute confirmation time interval as Bitcoin. However, many more transactions are processed within those 10 minutes, because more transactions are able to fit into the block that is being mined.

Prior to Bitcoin Cash, if a user wanted to speed up the processing time of their transaction (especially considering the block sizes were small, so not as many transactions can fit in a block), they had to tack on a hefty transaction fee to incentivize Bitcoin miners. Over time, this has made the Bitcoin network more conducive to processing larger transactions, where a larger processing fee is not as deterring for making the transaction. With automatically faster transactions due to increased block size, Bitcoin Cash allows for users to more readily send payments at very small fees. This helps Bitcoin Cash fulfill a nice for smaller micropayments (i.e. tipping a content creator), as well as be able to handle larger transactions.

Bitcoin Cash also did away with Bitcoin's Replace By Fee (RBF) feature. Thus, with Bitcoin Cash, double-spends are less likely because a user cannot spend money to make a purchase at a relatively lower fee at one merchant, then quickly go to another merchant and spend the same money (at a relatively higher fee) before the first purchase is confirmed; enabling them to spend the same money, twice and obtain double the value of goods and services.

TIMELINE, LEADERSHIP & DEVELOPMENT

In May of 2018, Bitcoin Cash developers agreed to fork the Bitcoin Cash blockchain in order to increase the block size from 8 MB to 32 MB. Roger Ver was an early investor in Bitcoin, and the biggest public advocate of the Bitcoin Cash fork. Roger, and other Bitcoin core developers, were upset that other Bitcoin developers refused to increase the block size of the network to accommodate more transactions. One of the main reasons that other developers did not want to increase the block size is due to the added potentials it would create towards centralization and lessened security.

Cointelegraph article on the timeline of events that lead to the Bitcoin Cash hard fork, as well as some important happenings, thereafter: cointelegraph.com/explained/bitcoin-block-size-explained

Click here for the official Bitcoin Cash roadmap.

Bitcoin Cash does not offer transparent leadership profiles or information on their main website, as of September 2019.

The Bitcoin Cash organization created a "Bitcoin Cash Development Fund" to help support developers that maintain the Bitcoin Cash network. Despite the development fund, Bitcoin Cash has some of the lowest development participation in their GitHub code repository, when compared to the other crypotocurrencies in the top 25 market cap.

Cointelegraph article on the timeline of events that lead to the Bitcoin Cash hard fork, as well as some important happenings, thereafter: cointelegraph.com/explained/bitcoin-block-size-explained

Click here for the official Bitcoin Cash roadmap.

Bitcoin Cash does not offer transparent leadership profiles or information on their main website, as of September 2019.

The Bitcoin Cash organization created a "Bitcoin Cash Development Fund" to help support developers that maintain the Bitcoin Cash network. Despite the development fund, Bitcoin Cash has some of the lowest development participation in their GitHub code repository, when compared to the other crypotocurrencies in the top 25 market cap.

TOKEN DISTRIBUTION & INFLATIONARY CONTROLS

The supply of Bitcoin and Bitcoin Cash is capped at 21 million. As of September 2019- both have close to 18 million coins in circulation, both have a block reward of 12.5 coins, per block mined, both are set for their next reward halving within 40 days of each other, however the difficulty level for mining bitcoin is considerably higher than it is for mining bitcoin cash.

Assuming Bitcoin Cash sticks to the 21m supply cap, the price per coin has a chance of going very high, if demand remains strong.

As I mention for supply of EVERY asset, ever- "The supply only matters as much as there is demand to outpace it, and by how much. This is what determines price/value."

NOTE: Although designed to be decentralized, there are a few large mining pools that are responsible for generating a vast majority of Bitcoin Cash supply.

Assuming Bitcoin Cash sticks to the 21m supply cap, the price per coin has a chance of going very high, if demand remains strong.

As I mention for supply of EVERY asset, ever- "The supply only matters as much as there is demand to outpace it, and by how much. This is what determines price/value."

NOTE: Although designed to be decentralized, there are a few large mining pools that are responsible for generating a vast majority of Bitcoin Cash supply.

CONSENSUS PROTOCOL

Bitcoin Cash uses Bitcoin's Proof of Work form of network consensus. The key difference is the transaction blocks being mined in Bitcoin Cash are considerably larger.

There is a lot of speculation in the Bitcoin Cash community about using a system called "Avalanche" as a pre-consensus supplement to the Bitcoin Cash Proof of Work consensus mechanism. Here is a fun video explaining Avalanche:

There is a lot of speculation in the Bitcoin Cash community about using a system called "Avalanche" as a pre-consensus supplement to the Bitcoin Cash Proof of Work consensus mechanism. Here is a fun video explaining Avalanche:

SECURITY

The PoW consensus design is a huge deterrent for DDoS attacks, because a hacker would have to use an enormous amount of energy to overwhelm a widely distributed network of nodes.

Smaller blocksizes that incentivize increased transaction fees can actually be a good thing because eventually the block rewards for miners no longer include new bitcoins; only rewarding miners with that block's transaction fees. If transaction fees are not high, thus appealing, miners do not have as much incentive to support the network. Fewer nodes supporting the network leads to more centralization, thus a network that is more vulnerable to a 51 percent, or DDoS attack.

The Bitcoin Cash hard fork made it more difficult to conduct a double-spend attack by doing away with the Replace By Fee (RBF) feature that Bitcoin uses. With no RBF, double-spends are less likely because a user cannot spend money to make a purchase at a relatively lower fee at one merchant, then quickly go to another merchant and spend the same money at a relatively higher fee (before the first purchase is confirmed); enabling them to spend the same money twice, and obtain double the value of goods and services.

The larger block sizes in Bitcoin Cash require miners to run more expensive hardware (use more hard disk space) to mine Bitcoin Cash. Smaller nodes will struggle to process increased amounts of data. This can contribute to mining being more centralized within larger entities that can afford the hardware.

The Bitcoin Cash hard fork created vulnerabilities known as a "Replay Attack". This allows users to conduct two transactions from a single wallet using the same set of keys.

Smaller blocksizes that incentivize increased transaction fees can actually be a good thing because eventually the block rewards for miners no longer include new bitcoins; only rewarding miners with that block's transaction fees. If transaction fees are not high, thus appealing, miners do not have as much incentive to support the network. Fewer nodes supporting the network leads to more centralization, thus a network that is more vulnerable to a 51 percent, or DDoS attack.

The Bitcoin Cash hard fork made it more difficult to conduct a double-spend attack by doing away with the Replace By Fee (RBF) feature that Bitcoin uses. With no RBF, double-spends are less likely because a user cannot spend money to make a purchase at a relatively lower fee at one merchant, then quickly go to another merchant and spend the same money at a relatively higher fee (before the first purchase is confirmed); enabling them to spend the same money twice, and obtain double the value of goods and services.

The larger block sizes in Bitcoin Cash require miners to run more expensive hardware (use more hard disk space) to mine Bitcoin Cash. Smaller nodes will struggle to process increased amounts of data. This can contribute to mining being more centralized within larger entities that can afford the hardware.

The Bitcoin Cash hard fork created vulnerabilities known as a "Replay Attack". This allows users to conduct two transactions from a single wallet using the same set of keys.

About Me:

BA in Economics. BS in Finance.

Hostess of the Crypt Keepers’ Club.

Passionate about research and data.

I don’t fold sheets, I spread them.

Hostess of the Crypt Keepers’ Club.

Passionate about research and data.

I don’t fold sheets, I spread them.

Connect with Me:

Note that you must be logged into Facebook to be directed to my page.

DISCLAIMER:

Keep in mind that information on this site is only from my perspective, and this industry is constantly evolving. Do more research. Be accountable for your decisions.

ALL INVESTMENTS ARE DONE SO AT YOUR OWN RISK!

Keep in mind that information on this site is only from my perspective, and this industry is constantly evolving. Do more research. Be accountable for your decisions.

ALL INVESTMENTS ARE DONE SO AT YOUR OWN RISK!

Have something constructive to add? Do so in this comment box, below.

BE KIND! Insecure egos do not appeal to anyone's better nature.

© COPYRIGHT 2017-2021 ALL RIGHTS RESERVED.